姣婆守唔到寡…

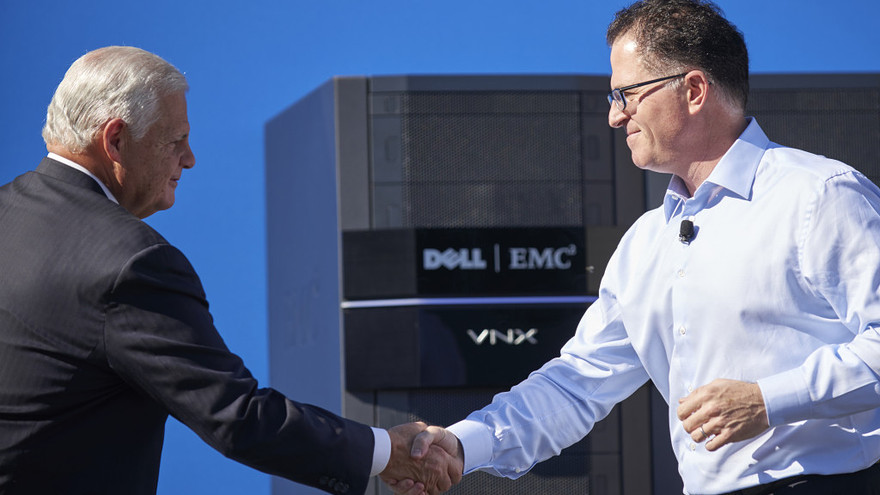

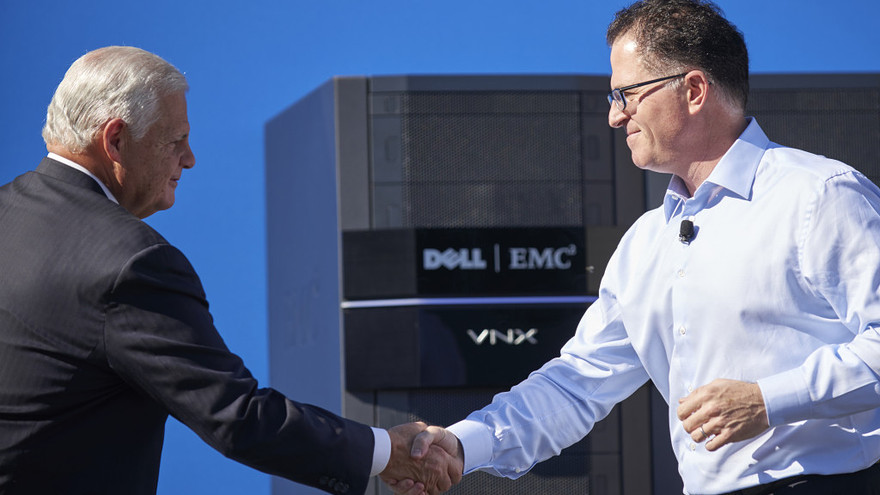

Dell Inc. founder and Chief Executive Michael Dell, right, and EMC Corp. CEO Joseph Tucci shake hands in an image provided by Dell after the merger of the two tech companies was announced Monday morning.

Dell Inc. is making its biggest move ever to expand beyond its personal-computing roots and compete directly with Hewlett-Packard Co.’s corporate business, buying EMC Corp. EMC, +1.76% But there are worrisome aspects to the largest tech deal in history.

One is the hefty debt load privately-held Dell is taking on in order to do the deal. The company expects to pay for the deal with cash on hand, a debt issuance and through the creation of a stock that will track Dell’s ownership interest in EMC’s virtualization software business, VMware Inc. VMW, EMC shareholders will receive $24.05 per share in cash and approximately $9.10 per share in the newly created VMware tracking stock, which didn’t seem to please VMware investors: While EMC’s stock ticked up slightly on the news, which was first reported last week, shares of VMware fell 8% Monday.

Dell hopes to pay down some of the debt through cost-cutting and the elimination of duplications and redundancies in the company. Michael Dell, the CEO of the company he founded in his college dorm in 1984, assured investors Monday the company was not taking on more than it could handle, even amid a threat of potential rising interest rates.

“I think what you’re going to see is in the first 18 months to 24 months, a significant de-leveraging coming from some cost synergies,” Dell told reporters on a conference call. ‘We have revenue synergies that are three times larger.”

Executives, though, declined to be more specific about what areas could see cuts or restructuring, preferring to focus on the more amorphous “revenue synergies,” which they told analysts were about $1 billion.

Analysts were not too keen on the idea that the companies would be looking to issue debt in an environment of rising interest rates.

“We still believe raising $33 billion plus in debt at reasonable interest rates will be challenging (but not impossible) for Dell,” Jeffries & Co. analyst James Kisner said .

Sanford Bernstein analyst Toni Sacconaghi said in a note on Monday that he believes Dell will have to raise about $45 billion in debt to finance the deal and that he was “a bit surprised that Dell was able to get financing,” according to the Wall Street Journal.

Meg Whitman, the chief executive of Hewlett-Packard HPQ, +0.00% believes Dell is going to face an ominous task raising that much debt, and she hopes H-P can take advantage of the confusion among customers as the companies embark on this massive deal.

“To pay back the interest on the $50 billion of debt that the new combined company will have on their balance sheet, Dell will need to pay roughly $2.5 billion a year in interest alone,” Whitman said in a company-wide email to employees obtained by MarketWatch. “That’s $2.5 billion that they will allocate away from R&D and other business critical activities, which will keep them from better serving their customer.

While Whitman’s comments can be seen as self-serving, H-P has its own experience with big mergers that sucked up its cash, notably the $11 billion deal for software company Autonomy, most of which it later wrote off. H-P also wrote down a huge chunk of its $14 billion acquisition of EDS, a computer services company, both moves that H-P did in a similar push for enterprise-focused businesses.

Whitman, whose tenure at H-P started with a mandate to strengthen the company’s then-weakened cash balance, contended that the company is “two years ahead of the game,” as it prepares for its own separation of its corporate server business from its printer and PC business at the end of this month.

“We’re organized, we have a strong balance sheet and our innovation engine is humming,” Whitman wrote. “So, get out in front of your customers and your partners. Tell them our story. Take advantage of this moment.”

In addition to the hefty debt load Dell is going to be saddled with, the company is going to have to again publicly report its financial results, as a result of its new tracking stock. EMC Chief Financial Officer Zane Rowe told analysts on a conference call that along with the tracking stock, “we would expect Dell to report financials.”

“We’ll become an SEC registrant and will report financials on their business as well as the VMware business,” Rowe said.

So in addition to adding on a pile of debt, Dell — which seemingly enjoyed being out of the public limelight as a private company — is now going to be foisted into the public glare again. At least investors will be able to track its progress in this mega-merger, but it’s unlikely to be an easy road.

(Market Watch)