次次見到人哋砌Rack都會好High!

Design + Mechanical + Hardware + Network, simply love this kind of stuff.

Design + Mechanical + Hardware + Network, simply love this kind of stuff.

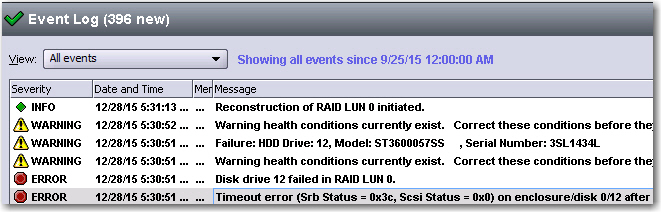

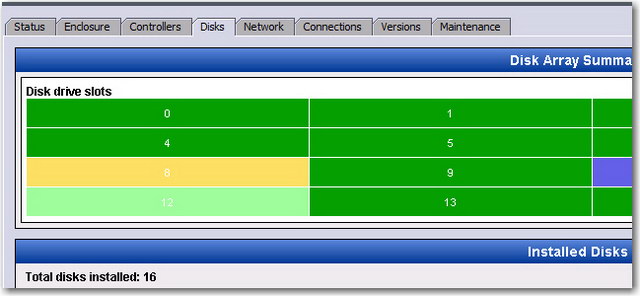

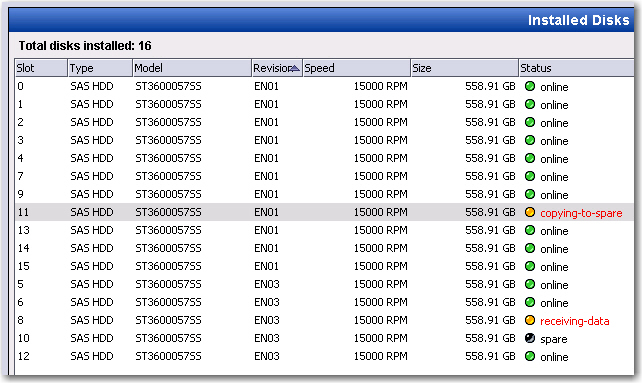

This is the 4th time Equallogic 15K SAS failed (previous failed record was on April 30, 2015), but this time comes with another surprise the local Dell logistic and inventory department called me saying they don’t have any stock currently!!! ARE YOU KIDDING ME? There are at least 50-60 Equallogic boxes running 600GB 15K SAS in Hong Kong and they don’t have the most failed parts in stock? and we paid for 4 hours Pro-Support replacement service…to be updated!

The RAID reconstruction took 3 hours and 40 mins to complete this time.

Update: Jan-15, 2016

5th time Equallogic 15K SAS failed.

Update: Jan-18, 2016

6th time Equallogic 15K SAS failed.

Whenever you see predicative failure kicks-in (ie, Copying to Spare), then you know it’s time to call Dell service, as all previous 3 predicative failures, none of it worked, the process always failed at half way.

Update: Jan-30, 2016

7th time Equallogic 15K SAS failed

4 disks failed one after another in 30 days is a Wow!!!

It seems the 5 years + SAS disks do have a life span of around 5 years warranty time, that’s why you need to extend your warranty for another 2 years as Dell gives maximum 7 years warranty for their enterprise products.

Update: Jul-15, 2016

8th time Equallogic 15K SAS failed

Don’t think predicative failure will help, so called pro-support right away to replace the failed disk.

Update: Oct-1, 2018

9th time Equallogic 15K SAS failed

After more than 2 years, finally it comes another disk failure, but this time the copy to spare was successful!

—————————————–

Level Received Member Message

Info 10/01/2018 04:43:05 AM eql01 Completed copying-to-spare operation from drive 4 to drive 15.

—————————————–

One interesting fact I found out, when I re-insert the failed disk, EQL produced the following error that I’ve never seen before.

—————————————–

History-of-Failures

ERROR event from storage array eql01

subsystem: SP

event: 14.4.18

time: Mon Oct 1 11:00:43 2018

0:Orphan disk drive: Disk drive LUN 4 (26bc078a0900-779214cc-8) no longer belongs to RAID LUN 0 (3be078a0900-b0e5c22b-92d39732). This disk has a history of failure and will not be used.

Update: Dec-2, 2018

10th time Equallogic 15K SAS failed, more than half of the disks are replaced, firmware EN03 from EN01.

Update: Dec-31, 2018

11th time Equallogic 15K SAS failed just before the end of 2018, this time is the first disk with firmware EN03.

Update: May-23, 2019

12th time Equallogic 15K SAS failed, firmware EN03 (TB EN03, Disk 0:0)

Update: Nov-15, 2020

13th time Equallogic 15K SAS failed, firmware EN03 (TB EN03, Disk 0:3)

Update: Jul-19, 2023

14th time Equallogic 15K SAS failed, firmware EN03 (TB EN01, Disk 0:5)

Update: Mar-1, 2024

15th time Equallogic 15K SAS failed, firmware EN00 (TB EE06, Disk 0:13)

=========================

Update: Jan-23, 2023

1st time Equallogic02 10K SAS failed (TB FE10, Disk 0:11)

Update: Feb-28, 2023

2nd time Equallogic02 10K SAS failed (TB FE10, Disk 0:12)

Update: Mar-13, 2023

3rd time Equallogic02 10K SAS failed (TB FE10, Disk 0:2)

Update: Mar-26, 2023

4th time Equallogic02 10K SAS failed (TB FE10, Disk 0:3)

Update: Mar-27, 2023

5th time Equallogic02 10K SAS failed (TB FE10, Disk 0:2)

Update: Mar-28, 2023

6th time Equallogic02 10K SAS failed (TB FE10, Disk 0:4)

Update: Mar-30, 2023

7th time Equallogic02 10K SAS failed (TB FE10, Disk 0:6)

Update: Apr-08, 2023

8th time Equallogic02 10K SAS failed (TB FE10, Disk 0:11)

Update: Apr-16, 2023

9th time Equallogic02 10K SAS failed (TB FE10, Disk 0:3)

10th time Equallogic02 10K SAS failed (TB FE10, Disk 0:10)

Update: Apr-17, 2023

11th time Equallogic02 10K SAS failed (TB FE10, Disk 0:7)

Update: Apr-24, 2023

12th time Equallogic02 10K SAS failed (TB FE10, Disk 0:15)

Update: May-6, 2023

13th time Equallogic02 10K SAS failed (TB FE10, Disk 0:3)

Update: May-20, 2023

14th time Equallogic02 10K SAS failed (TB FE10, Disk 0:0)

Update: Jun-8, 2023

15th time Equallogic02 10K SAS failed (TB FE10, Disk 0:21)

Update: Jul-14, 2023

16th time Equallogic02 10K SAS failed (TB FE10, Disk 0:11)

The following is very interesting as they are currently the new kids on the block in storage world!

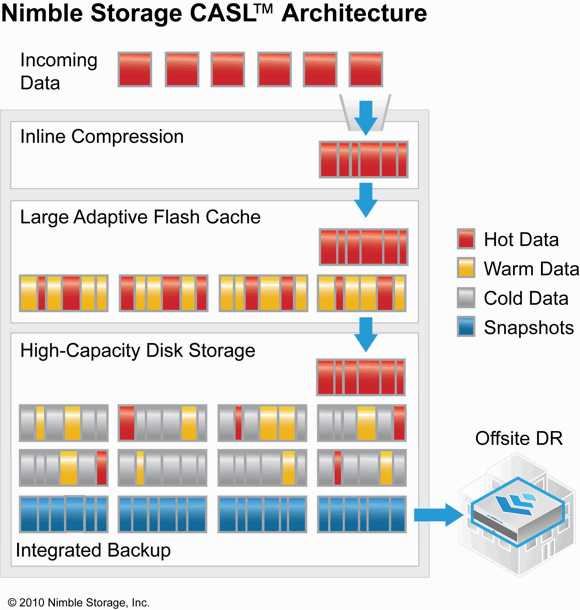

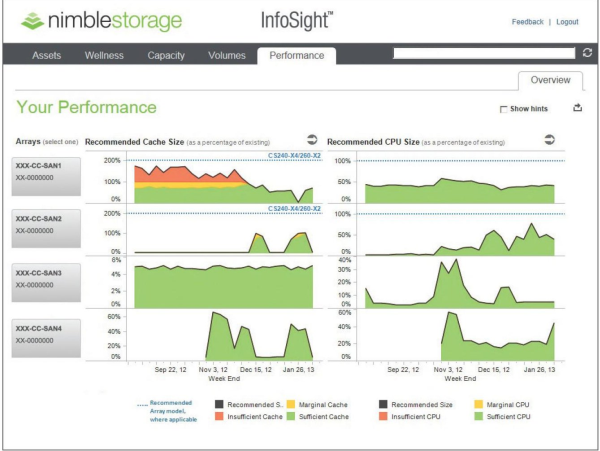

Recently, I’ve talked to Nimble’s senior technical consultant during the VMWorld Expo in Hong Kong, and indeed they are very similar to Equallogic…ie, downside is Nimble too can’t stand any of the array failed in the same cluster (Lefthand can) and no build-in thin reclaim feature (3Par does) and Nimble is limited to 4 nodes in comparison to Equallogic’s 16 nodes.

However Nimble is with SSD built into their array design and firmware from day one, so the performance is much better even with the same set of hardware. So if your site is mainly used for VDI, then Nimble should be on your next purchase consider list.

“Dell has become a top-four player in disk arrays, as IBM and NetApp are left behind in Gartner’s 2015 Magic Quadrant for general purpose disk arrays…Nimble Storage enters the leaders’ quadrant for the first time” (Read More)

Also please refer to the latest Gartner Magic Quadrant for General-Purpose Disk Arrays (Published: October 2015)

Of course, there is one main thing I don’t really like…Nimble and Tegile have a rather simple admin GUI (here is Tegile), it’s not really graphical oriented as Equallogic’s group manager…for the record, GUI is also one of the most important things for me to decide on a SAN storage purchase. Not to mention Equallogic has a deep inspection tool..SQNHQ…which I couldn’t find the same level of deep analysis on both Nimble (InfoSight cloud based?) and Tegile GUI.

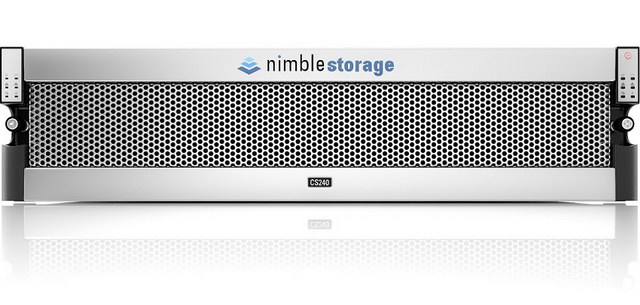

Besides, Image is everything…the actual design of the array itself (box and tray) does not look good as Equallogic…thought I have to admit the face plates for both Nimble and Tegile look cool…but somehow it doesn’t match with the array design behind it, strange…probably the designers are different for face plate and array.

Yes, Nimble’s snapshot compression and de-duplication are good, but there is always a trade off in performance as compression requires CPU time to process. Fyi, Equallogic firmware 8.0 has this similar build-in snapshot compression already. After all, it seems to me both Nimble and Tegile are putting space utilization as its 1st priority selling point than it’s SSD performance, so Equallogic has no choice but to catch up. Seemed Nimble and Tegile are really pushing Dell hard for this!!! Finally Equallogic has to change under pressure which is really good for its customer.

The other thing is Nimble and Tegile is x86 based hardware (Ah…SuperMicro!!!) while Equallogic uses propitiatory RISC based CPU and Nimble’s firmware (ie, software) is based on open source Linux cluster file system (GFS? To be confirmed).

One more thing I don’t like Nimble and Tegile is their disk reliability, 7,200RPM SATA, come on, it’s confirmed those SATA are really unreliable and risky, I wouldn’t trust putting our mission critical data on those disks for sure. Even for our Equallogic 15K SAS, the failure rate per array is almost 1/16 every year…read too many horrible stories about those SATA array (ie, PS4100 series), just plain scary!

Last but not least, probably the most important one…price!!! Nimble or Tegile isn’t cheap really…as a new comer, I think it at least should have an attractive selling price in order for others to switch from the big bothers.

Still…IMOO, somehow, I still wouldn’t classify both Nimble and Tegile as the next generation of SAN vendors and it’s interesting to see Nimble’s founder were actually from Netapp…this reminds me Fortinet’s founder was actually from Netscreen (btw, both founders are Chinese)

Finally, there is an interesting report on Hybrid-Storage-Array-Buyers-Guide by DCIG

Nimble and Tegile: The new Lefthand and EqualLogic by John Sloan

Which hybrid storage solution should we go with, Nimble or Tegile? You can tell when a technology has crossed the Rubicon of acceptance when the question shifts from validating the technology to comparing the leading evangelists of the new approach.

In this case the new technology or approach is hybrid storage which includes solid state with traditional disk. A couple of years ago organizations wanted information on solid state storage and whether solid state would help mitigate IO bottlenecks. Were the IOPS worth the higher cost per gigabyte of solid state?

Today hybrids are hot and just about everybody has a scheme for adding solid state either as a cache layer or a solid state drive (SSD) tier. Nimble and Tegile stand out because they are built from the ground up to be optimized for a mix of solid state and spinning disk. They both argue that traditional storage is built for disk even if it has solid state added to the mix.

Seven or eight years ago the new storage technology was iSCSI. Fibre Channel was the dominant architecture for storage networks and arrays. But some feisty start-ups started championing this idea of wrapping SCSI storage blocks in internet protocol and pushing it across Ethernet networks.

Two of the bright stars in that iSCSI firmament were LeftHand Networks and EqualLogic. There were other players to be sure but these were the two I heard about most from storage buying prospects, especially in small to midsize organizations. Somewhere during 2007 the predominant question from these prospects went from “Should we consider iSCSI solutions?” to “Which iSCSI storage solution should we go with, Lefthand or EqualLogic?”.

Then, as now, it was server visualization that pushed the start-ups into the limelight. Once VMware supported iSCSI for shared storage, midsized organizations buying their first SAN array for server consolidation/virtualization got very interested in Lefthand and EqualLogic.

The trigger now is the need to maintain consistent IOPS for virtual deskop initiatives. Failure of traditional shared storage to scale to VDI boot storms derailed many an implementation. Nimble and Tegile want to be your core storage platform but VDI has been their foot in the door of the data center.

So which of the two should you go with? Nimble or Tegile? Well, of course, it depends. Of the contests I’ve seen over this past summer, among organizations that have shortlisted both vendors, I can say that the two have been competing neck and neck. Those that have made their decisions say it was an extremely close run thing. From what I’ve seen:

Nimble seems to win over Tegile on cost, both upfront acquisition costs and expected future expansion/scaling costs.

Where Tegile wins over Nimble is in technology. More than one potential customer has told me that they really like how Tegile works. Tegile also supports multiple connection protocols where Nimble is iSCSI-only (that will likely change before the end of 2015).

We ranked both Nimble and Tegile as innovators in our most recent Vendor Landscape: Small to Mid-Range Storage Arrays. Tegile got kudos and ranked higher for their technology.

But as noted it is a very close run thing. Where one leads over another it is by degrees, not a slam-dunk differentiation. There is also the usual caution over risk of going with the small (albeit rapidly growing) start-ups over established players.

Lefthand and EqualLogic were both eventually acquired by HP and Dell respectively. A similar pattern was repeated with two other upstart storage innovators 3par and Compellent.

If you can’t beat them buy them. The established players are struggling right now to beat Nimble and Tegile. But the usual mainline storage suspects have pretty crowded portfolios right now.They may not have room for a Tegile or a Nimble.

Nimble vs EQuallogic by Austin Henderson

The debate between Equallogic and Nimble essentially came down to the fact that we really liked the offering and the people of Nimble but questioned their staying capacity in the market. We were fearful that we would either purchase the product and it would not perform as advertised or that we would purchase the product and in two years they would be gone as a company.

The Equallogic brand name is a solid name and has a lot of experience to stand strong upon, but our research kept turning up some questions about how they had elected to employ snapshots in their platform and we reasoned that our ability to store snaps of our data on that device would be reduced in comparison to the Nimble product. This fear combined with the lack of follow through and inadequate justification of questions by EQ references and sales engineers confirmed our suspicion of the product as inferior in a technical sense.

To address the Nimble performance numbers we discussed with existing customers how the array performed and convinced them to give us 60 day terms on the purchase order – thus if it didn’t perform we would box it up and send it back. After review with other customers and their engineers we were fairly confident this would not be the case and as such decided we could take that risk.

Our Nimble array arrived and was installed with the help of two Nimble resources in very short order. Testing began shortly after install and within approximately a month all production data was moved to the device. Our RPO stretches backwards in excess of several weeks in some cases and the innovative approach to how the product takes data snapshots combined with thin provisioning and inline compression.

Our performance numbers are better than we could have imagined thanks to the use of SSD drives and while not measured yet the energy requirements have dropped considerably given that we went from 60 – 15K spinning drives to 4 SSD drives and 12 spinning drives. Currently we have seen very few spikes above 3K IOPS and the device can scale on random read/write layout to approximately 15K – thus we have headroom to spare.

In the end the lasting power of the company remains to be seen – and we have our doubts – but conversations with the CEO and other leaders in the company lead us to believe the intent of the company is to leave their mark on the storage industry, not to exit stage right. Given our experiences thus far I would say they are headed for such a legacy and we are proud of and stand by our selection.”

It turns out to be quite an introductory level one…but it’s nice to see Dell’s demo server room, and I noticed the PS6100 has two disks failed as well. ![]()

竟然發現了Equallogic的蹤跡,當然已經是很舊很舊的型號了。 但是如果沒了Firmware,就等同一塊廢鐵般Useless。

這個Controller更舊,完全不知道是什麼型號。

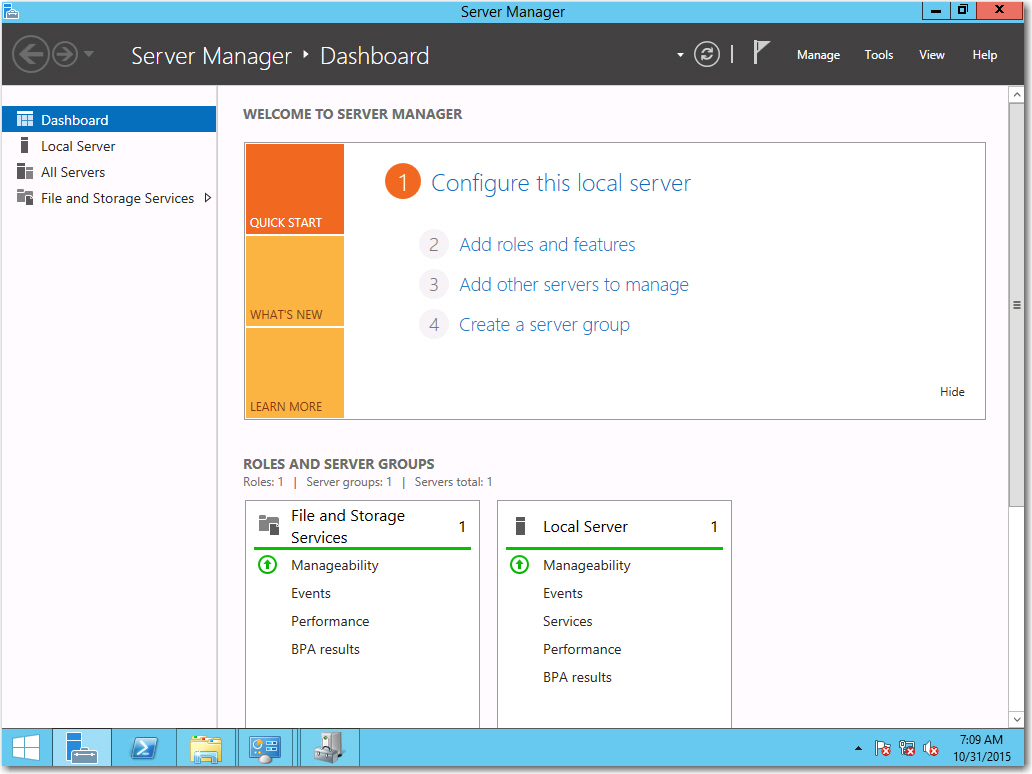

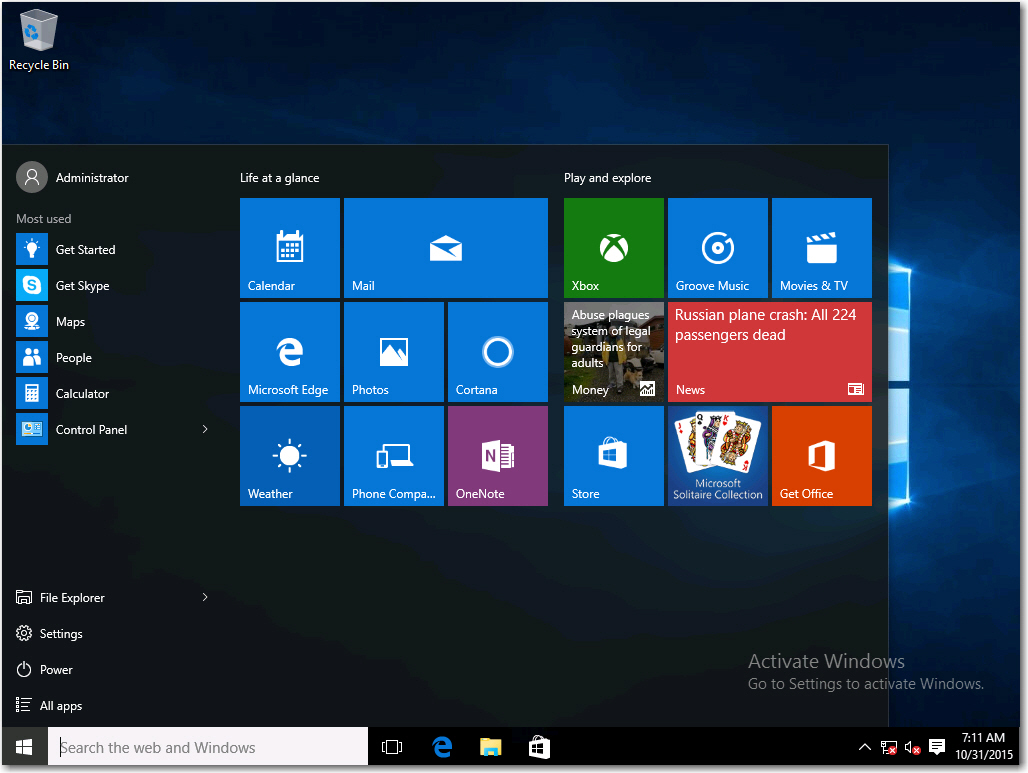

Well, you didn’t mis-read the above! Yes, I finally managed to get both (W2K12R2 & Win10) running under the old daddy VMWare ESX 4.1 with the latest VMTools installed, not supported? Huh? You must be kidding me.

1. Basically, in order to run your OEM copy of Windows Server 2012 R2, you will need to select Windows Server 2008 R2 as the OS template. Also you need the latest SLIC 2.3 ROM, the correct Dell Cert and of course a valid OEM Key.

2. De-select the default video driver (ie, WDDM) when installing VMware Tools or you will get a black screen immediately. At least this is true on Windows 10, but somehow no problem with W2K12R2. Details please refer to this blog article. (Update: actually you don’t need to install VMware Tools here)

3. Still, you will find the mouse isn’t working smoothly in W2K12R2 and Win10, this happens to both Windows Server 2012 and Windows 8 as well, and the solution is simple, download and install the latest VMWare Tools which comes with the updated drivers for video (VMware SVGA 3D), disk controller (PVSCSI) and network cards (VMnet3).

4. Again, after you have successful upgraded your VMWare Tools, then you will need to create a 1MB hard disk and select the SCSI to 1:0 and change the secondary controller type to Paravirtual, restart the VM, shut it down, change the primary hard disk controller to Paravirtual as well, finally remove the 2nd disk and controller. Viola, there is your lightening fast PVSCSI disk!

5. The other things I discover W2K12R2 and WIN10 keeps crashing for every 3-5 hours without any reason, then I found this KB which solved the problem, and make sure you applied all the windows updates.

6. Another tips is to turn off the Sleep Mode under Power Option in Windows 10, or you will face VM constantly went to sleep and hence VMTools status always shows “Not Running”.

7. Finally I discover you can install the latest Linux CentOS 7.x and Ubuntu 15.x without any problem on ESX 4.1 although it’s not listed as supported OS…strange, but working perfectly fine which leads me to think we can in fact install any updated OS on the much older ESX 4.1. One hint is to download the latest VMTools and install it! (Actually you don’t need as somehow CentOS 7-1611 comes with VMTools automatically somehow)

8. I also noticed those Linux VMware Tools status shows as “Unmanaged”! That’s actually ok, as the tools is installed from the latest package instead of using the default attached CD-ROM (which the version doesn’t work anyway), so you can safely ignore it.

So who said these two latest OS from Microsoft aren’t supported on ESX4.1? Think again. ![]()

Update: May 15, 2017

Tested the latest CentOS 7-1611 also worked perfectly on ESX4.1.

Update: Oct 10, 2017

Problem found W2K12 constantly hangs, finally identified it’s the old anti-virus program Symantec Endpoint Protection that’s causing the conflicts, you will need the version at least v14.0.2415 in order for the OS to be stable.

Update: Dec 25, 2017

It turns out Windows Server 2016 follows exactly the above step and I can confirm W2K16 is running happily on ESX 4.1 without any problem! Except you need to have SLIC 2.4 BIOS!

姣婆守唔到寡…

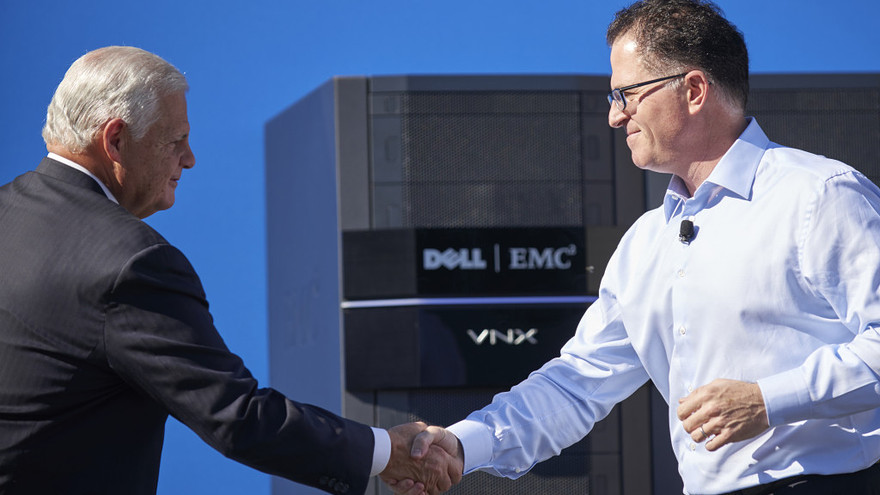

Dell Inc. founder and Chief Executive Michael Dell, right, and EMC Corp. CEO Joseph Tucci shake hands in an image provided by Dell after the merger of the two tech companies was announced Monday morning.

Dell Inc. is making its biggest move ever to expand beyond its personal-computing roots and compete directly with Hewlett-Packard Co.’s corporate business, buying EMC Corp. EMC, +1.76% But there are worrisome aspects to the largest tech deal in history.

One is the hefty debt load privately-held Dell is taking on in order to do the deal. The company expects to pay for the deal with cash on hand, a debt issuance and through the creation of a stock that will track Dell’s ownership interest in EMC’s virtualization software business, VMware Inc. VMW, EMC shareholders will receive $24.05 per share in cash and approximately $9.10 per share in the newly created VMware tracking stock, which didn’t seem to please VMware investors: While EMC’s stock ticked up slightly on the news, which was first reported last week, shares of VMware fell 8% Monday.

Dell hopes to pay down some of the debt through cost-cutting and the elimination of duplications and redundancies in the company. Michael Dell, the CEO of the company he founded in his college dorm in 1984, assured investors Monday the company was not taking on more than it could handle, even amid a threat of potential rising interest rates.

“I think what you’re going to see is in the first 18 months to 24 months, a significant de-leveraging coming from some cost synergies,” Dell told reporters on a conference call. ‘We have revenue synergies that are three times larger.”

Executives, though, declined to be more specific about what areas could see cuts or restructuring, preferring to focus on the more amorphous “revenue synergies,” which they told analysts were about $1 billion.

Analysts were not too keen on the idea that the companies would be looking to issue debt in an environment of rising interest rates.

“We still believe raising $33 billion plus in debt at reasonable interest rates will be challenging (but not impossible) for Dell,” Jeffries & Co. analyst James Kisner said .

Sanford Bernstein analyst Toni Sacconaghi said in a note on Monday that he believes Dell will have to raise about $45 billion in debt to finance the deal and that he was “a bit surprised that Dell was able to get financing,” according to the Wall Street Journal.

Meg Whitman, the chief executive of Hewlett-Packard HPQ, +0.00% believes Dell is going to face an ominous task raising that much debt, and she hopes H-P can take advantage of the confusion among customers as the companies embark on this massive deal.

“To pay back the interest on the $50 billion of debt that the new combined company will have on their balance sheet, Dell will need to pay roughly $2.5 billion a year in interest alone,” Whitman said in a company-wide email to employees obtained by MarketWatch. “That’s $2.5 billion that they will allocate away from R&D and other business critical activities, which will keep them from better serving their customer.

While Whitman’s comments can be seen as self-serving, H-P has its own experience with big mergers that sucked up its cash, notably the $11 billion deal for software company Autonomy, most of which it later wrote off. H-P also wrote down a huge chunk of its $14 billion acquisition of EDS, a computer services company, both moves that H-P did in a similar push for enterprise-focused businesses.

Whitman, whose tenure at H-P started with a mandate to strengthen the company’s then-weakened cash balance, contended that the company is “two years ahead of the game,” as it prepares for its own separation of its corporate server business from its printer and PC business at the end of this month.

“We’re organized, we have a strong balance sheet and our innovation engine is humming,” Whitman wrote. “So, get out in front of your customers and your partners. Tell them our story. Take advantage of this moment.”

In addition to the hefty debt load Dell is going to be saddled with, the company is going to have to again publicly report its financial results, as a result of its new tracking stock. EMC Chief Financial Officer Zane Rowe told analysts on a conference call that along with the tracking stock, “we would expect Dell to report financials.”

“We’ll become an SEC registrant and will report financials on their business as well as the VMware business,” Rowe said.

So in addition to adding on a pile of debt, Dell — which seemingly enjoyed being out of the public limelight as a private company — is now going to be foisted into the public glare again. At least investors will be able to track its progress in this mega-merger, but it’s unlikely to be an easy road.

(Market Watch)

This really came handy and got rid of that annoying useless repair mode after a power outage.

at CMD, type:

bcdedit /set {default} recoveryenabled No

bcdedit /set {default} bootstatuspolicy ignoreallfailures

Today, one of my clients has complained his server is running out of space abnormally, using WinDirStat, I was able to identify the cause of the problem.

It was the MSSQL log files occupied over 20GB of space. The clean up process is pretty straight forward, manually run “EXEC sp_cycle_errorlog” 6 times or more depending how many log copies you kept, the command erased all those gigantic log files and freed up the space as you wished for, simple as that.

There is always something new for me to learn everyday, which is a good thing! ![]()

Note: Struggled a bit trouble when login back to Mirosoft SQL Server Management Studio, as the correct format for Server Name is /your_server_name/SQLEXPRESS.

Recently, one of the web server suddenly stopped from taking any request, restarted IIS WWW service won’t help, and there is no W3WP.exe in the process at all! Everything else seems normal, of course restarting the whole server helps, but it will happen again in a few months, so this is not the permanent solution.

Then I found out there are tons of “Connections_refused” entries are logged in the Httperr.log, it turns out the server has run out of non-pool memories.

Work around for this issue is to add the EnableAggressiveMemoryUsage registry entry to the following registry subkey:

Then, set the EnableAggressiveMemoryUsage registry entry to 1.

To do this, follow these steps:

By default, the HTTP service in IIS 6.0 stops accepting connections when nonpaged pool memory reaches 20 MB. When you enable the EnableAggressiveMemoryUsage registry entry, the HTTP service stops accepting connections when nonpaged pool memory reaches 8 MB.